The 2025 Florida Use Tax

The 2025 Florida Use Tax

6.00%

The Florida use tax is a special excise tax assessed on property purchased for use in Florida in a jurisdiction where a lower (or no) sales tax was collected on the purchase.

The Florida use tax should be paid for items bought tax-free over the internet, bought while traveling, or transported into Florida from a state with a lower sales tax rate.

The Florida use tax rate is 6%, the same as the regular Florida sales tax. Including local taxes, the Florida use tax can be as high as 1.500%.

What exactly is the Florida use tax?

What exactly is the Florida use tax?

The Florida Use Tax is a little-known tax that complements the regular Florida sales tax to ensure that purchases made outside of Florida are not exempt from the Florida sales tax.

Instead of taxing the sale of tangible property which takes place outside of Florida's jurisdiction (and thus cannot be taxed), the Florida Use Tax taxes the use or consumption of tangible property bought in other jurisdictions with a lower sales tax rate and brought back into Florida.

How Do I Calculate How Much Use Tax I Owe?

How Do I Calculate How Much Use Tax I Owe?

If you made any purchases online or outside of Florida for which you paid less then Florida's 6% in sales tax, you are responsible for paying Florida a use tax on those purchases equal to 6% of the total purchase price less any sales taxes already paid to other jurisductions.

Example 1: If $100 worth of books is purchased from an online retailer and no sales tax is collected, the buyer would become liable to pay Florida a total of $100 × 6% = $6.00 in use tax.

Example 2: If a $10,000 boat is purchased tax-free and then brought into a jurisdiction with a 4% sales tax rate, the buyer would become liable to pay Florida a total of (6% - 4%) × $10,000 = $600.00 in use tax.

Example 3: If $1,000 worth of goods are purchased in a jurisdiction with a 7% sales tax rate, no use tax is owed to Florida because the foreign jurisdiction's sales tax rate is greater then or equal to Florida's 6% sales tax.

How do I pay the Florida use tax?

How do I pay the Florida use tax?

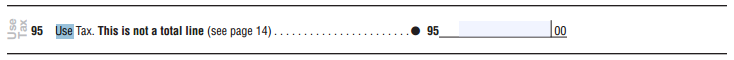

In many states, an optional field for remitting use tax is included in the state income tax return. A use tax return form may also be available on the Florida Department of Revenue website for calculating and paying use tax.

Above: Example use tax field on a state income tax return

Above: Example use tax field on a state income tax return

Use tax is a self-assessed tax with a very low public awareness rate, and as a result states have a very hard time enforcing use tax compliance. Only about 1.6% of taxpayers pay use tax each year, remitting an average of $69 in use taxes on total purchases averaging $929. [1]

Government studies have shown that a large percentage of use tax payments are made as the result of an audit or under the threat of an audit. If unpaid use tax is discovered by a Florida tax audit, significant underpayment fees and interest may apply.

How can we improve this page? We value your comments and suggestions!

How can we improve this page? We value your comments and suggestions! Send Instant Feedback About This Page

Donate BitCoin:

Donate BitCoin: